Mahoning County Property Tax Homestead Exemption . Every senior citizen or permanently disabled homeowner will receive an exemption of $25,000 on the appraised value of their home from property taxes on a single. Pay your property taxes online from the tax tab of your property search. An official state of ohio site. Do i qualify for the homestead exemption program for tax year 2023 collected in calendar year 2024? What do i bring with me to. How do i apply for the homestead exemption. To receive the homestead exemption you must. You may qualify for the homestead exemption program for tax year 2023 collected in calendar year 2024 if: Qualifications for the homestead exemption for real property and manufactured or mobile homes: Do i qualify for the homestead exemption program for tax year 2023 collected in calendar year 2024? What do i bring with me to apply for the. 2023 annual legal notice to taxpayers ty23 py24 taxes are certified.

from blanker.org

Pay your property taxes online from the tax tab of your property search. What do i bring with me to apply for the. An official state of ohio site. 2023 annual legal notice to taxpayers ty23 py24 taxes are certified. What do i bring with me to. You may qualify for the homestead exemption program for tax year 2023 collected in calendar year 2024 if: Every senior citizen or permanently disabled homeowner will receive an exemption of $25,000 on the appraised value of their home from property taxes on a single. Do i qualify for the homestead exemption program for tax year 2023 collected in calendar year 2024? Qualifications for the homestead exemption for real property and manufactured or mobile homes: Do i qualify for the homestead exemption program for tax year 2023 collected in calendar year 2024?

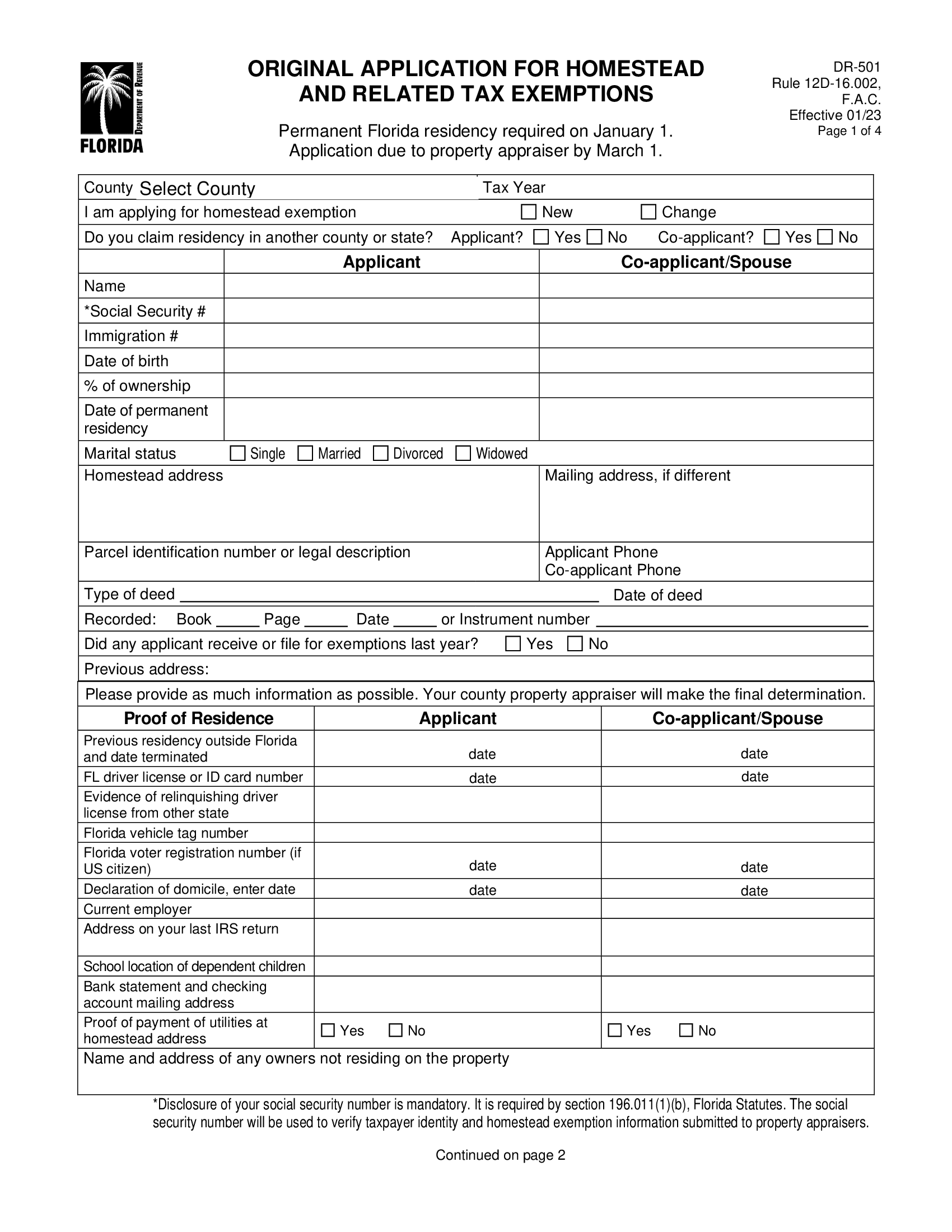

Form DR501. Original Application for Homestead and Related Tax

Mahoning County Property Tax Homestead Exemption Do i qualify for the homestead exemption program for tax year 2023 collected in calendar year 2024? To receive the homestead exemption you must. Pay your property taxes online from the tax tab of your property search. Do i qualify for the homestead exemption program for tax year 2023 collected in calendar year 2024? What do i bring with me to apply for the. How do i apply for the homestead exemption. 2023 annual legal notice to taxpayers ty23 py24 taxes are certified. Qualifications for the homestead exemption for real property and manufactured or mobile homes: Every senior citizen or permanently disabled homeowner will receive an exemption of $25,000 on the appraised value of their home from property taxes on a single. You may qualify for the homestead exemption program for tax year 2023 collected in calendar year 2024 if: Do i qualify for the homestead exemption program for tax year 2023 collected in calendar year 2024? An official state of ohio site. What do i bring with me to.

From jaimebdarline.pages.dev

Texas Property Taxes Homestead Exemption 2024 Dawna Sondra Mahoning County Property Tax Homestead Exemption Pay your property taxes online from the tax tab of your property search. To receive the homestead exemption you must. An official state of ohio site. What do i bring with me to. Every senior citizen or permanently disabled homeowner will receive an exemption of $25,000 on the appraised value of their home from property taxes on a single. How. Mahoning County Property Tax Homestead Exemption.

From www.exemptform.com

Harris County Homestead Exemption Form Mahoning County Property Tax Homestead Exemption An official state of ohio site. Pay your property taxes online from the tax tab of your property search. You may qualify for the homestead exemption program for tax year 2023 collected in calendar year 2024 if: 2023 annual legal notice to taxpayers ty23 py24 taxes are certified. Qualifications for the homestead exemption for real property and manufactured or mobile. Mahoning County Property Tax Homestead Exemption.

From ronniqkaterina.pages.dev

California Homestead Exemption 2024 Cornie Kerrie Mahoning County Property Tax Homestead Exemption Qualifications for the homestead exemption for real property and manufactured or mobile homes: To receive the homestead exemption you must. Do i qualify for the homestead exemption program for tax year 2023 collected in calendar year 2024? Pay your property taxes online from the tax tab of your property search. An official state of ohio site. How do i apply. Mahoning County Property Tax Homestead Exemption.

From www.youtube.com

Texas Homestead Exemption Explained How to Fill Out Texas Homestead Mahoning County Property Tax Homestead Exemption What do i bring with me to apply for the. An official state of ohio site. 2023 annual legal notice to taxpayers ty23 py24 taxes are certified. What do i bring with me to. How do i apply for the homestead exemption. Qualifications for the homestead exemption for real property and manufactured or mobile homes: Do i qualify for the. Mahoning County Property Tax Homestead Exemption.

From www.youtube.com

Mahoning County property tax mailings coming soon YouTube Mahoning County Property Tax Homestead Exemption What do i bring with me to apply for the. Do i qualify for the homestead exemption program for tax year 2023 collected in calendar year 2024? Pay your property taxes online from the tax tab of your property search. To receive the homestead exemption you must. Do i qualify for the homestead exemption program for tax year 2023 collected. Mahoning County Property Tax Homestead Exemption.

From jerryrhollandxo.blob.core.windows.net

How Do I Apply For Homestead Exemption In Indiana Mahoning County Property Tax Homestead Exemption You may qualify for the homestead exemption program for tax year 2023 collected in calendar year 2024 if: What do i bring with me to. Do i qualify for the homestead exemption program for tax year 2023 collected in calendar year 2024? 2023 annual legal notice to taxpayers ty23 py24 taxes are certified. Qualifications for the homestead exemption for real. Mahoning County Property Tax Homestead Exemption.

From blanker.org

Form DR501. Original Application for Homestead and Related Tax Mahoning County Property Tax Homestead Exemption 2023 annual legal notice to taxpayers ty23 py24 taxes are certified. Do i qualify for the homestead exemption program for tax year 2023 collected in calendar year 2024? Every senior citizen or permanently disabled homeowner will receive an exemption of $25,000 on the appraised value of their home from property taxes on a single. Pay your property taxes online from. Mahoning County Property Tax Homestead Exemption.

From www.countyforms.com

Fillable Original Application For Homestead And Related Tax Exemptions Mahoning County Property Tax Homestead Exemption To receive the homestead exemption you must. Qualifications for the homestead exemption for real property and manufactured or mobile homes: Do i qualify for the homestead exemption program for tax year 2023 collected in calendar year 2024? Do i qualify for the homestead exemption program for tax year 2023 collected in calendar year 2024? 2023 annual legal notice to taxpayers. Mahoning County Property Tax Homestead Exemption.

From tiertzawgodiva.pages.dev

Texas Homestead Exemption Changes 2024 Tonia Katrina Mahoning County Property Tax Homestead Exemption Pay your property taxes online from the tax tab of your property search. Do i qualify for the homestead exemption program for tax year 2023 collected in calendar year 2024? Every senior citizen or permanently disabled homeowner will receive an exemption of $25,000 on the appraised value of their home from property taxes on a single. 2023 annual legal notice. Mahoning County Property Tax Homestead Exemption.

From www.signnow.com

Homestead Exemption Complete with ease airSlate SignNow Mahoning County Property Tax Homestead Exemption What do i bring with me to apply for the. Every senior citizen or permanently disabled homeowner will receive an exemption of $25,000 on the appraised value of their home from property taxes on a single. What do i bring with me to. To receive the homestead exemption you must. Do i qualify for the homestead exemption program for tax. Mahoning County Property Tax Homestead Exemption.

From www.fbcad.org

How To Complete Your Business Personal Property Rendition (Form 50144 Mahoning County Property Tax Homestead Exemption Pay your property taxes online from the tax tab of your property search. To receive the homestead exemption you must. How do i apply for the homestead exemption. What do i bring with me to apply for the. Qualifications for the homestead exemption for real property and manufactured or mobile homes: 2023 annual legal notice to taxpayers ty23 py24 taxes. Mahoning County Property Tax Homestead Exemption.

From www.exemptform.com

Travis County Homestead Property Exemption Forms Mahoning County Property Tax Homestead Exemption What do i bring with me to. Qualifications for the homestead exemption for real property and manufactured or mobile homes: Do i qualify for the homestead exemption program for tax year 2023 collected in calendar year 2024? Do i qualify for the homestead exemption program for tax year 2023 collected in calendar year 2024? 2023 annual legal notice to taxpayers. Mahoning County Property Tax Homestead Exemption.

From www.slideshare.net

Homestead exemption form Mahoning County Property Tax Homestead Exemption What do i bring with me to apply for the. Do i qualify for the homestead exemption program for tax year 2023 collected in calendar year 2024? Pay your property taxes online from the tax tab of your property search. 2023 annual legal notice to taxpayers ty23 py24 taxes are certified. To receive the homestead exemption you must. You may. Mahoning County Property Tax Homestead Exemption.

From www.michaelsaunders.com

Florida Property Taxes Your Guide to Filing for Homestead Exemption Mahoning County Property Tax Homestead Exemption Do i qualify for the homestead exemption program for tax year 2023 collected in calendar year 2024? Do i qualify for the homestead exemption program for tax year 2023 collected in calendar year 2024? An official state of ohio site. Qualifications for the homestead exemption for real property and manufactured or mobile homes: 2023 annual legal notice to taxpayers ty23. Mahoning County Property Tax Homestead Exemption.

From www.dochub.com

Tarrant county homestead exemption form Fill out & sign online DocHub Mahoning County Property Tax Homestead Exemption Pay your property taxes online from the tax tab of your property search. Do i qualify for the homestead exemption program for tax year 2023 collected in calendar year 2024? Every senior citizen or permanently disabled homeowner will receive an exemption of $25,000 on the appraised value of their home from property taxes on a single. What do i bring. Mahoning County Property Tax Homestead Exemption.

From www.exemptform.com

Florida Homestead Exemption Form Broward County Mahoning County Property Tax Homestead Exemption Do i qualify for the homestead exemption program for tax year 2023 collected in calendar year 2024? 2023 annual legal notice to taxpayers ty23 py24 taxes are certified. What do i bring with me to apply for the. You may qualify for the homestead exemption program for tax year 2023 collected in calendar year 2024 if: An official state of. Mahoning County Property Tax Homestead Exemption.

From news.yahoo.com

Mahoning County auditor talks property tax rates Mahoning County Property Tax Homestead Exemption Pay your property taxes online from the tax tab of your property search. How do i apply for the homestead exemption. You may qualify for the homestead exemption program for tax year 2023 collected in calendar year 2024 if: An official state of ohio site. To receive the homestead exemption you must. Do i qualify for the homestead exemption program. Mahoning County Property Tax Homestead Exemption.

From www.exemptform.com

Application For Nueces Residence Homestead Exemption Fill Online Mahoning County Property Tax Homestead Exemption 2023 annual legal notice to taxpayers ty23 py24 taxes are certified. Pay your property taxes online from the tax tab of your property search. How do i apply for the homestead exemption. Do i qualify for the homestead exemption program for tax year 2023 collected in calendar year 2024? Every senior citizen or permanently disabled homeowner will receive an exemption. Mahoning County Property Tax Homestead Exemption.